Would your company be able to survive the death or disability of a key employee?

How much would it hurt your business to suddenly lose one of your top people.

Alex was a highly successful medical sales rep. One day while on the road, she suffered a massive heart attack and died. Her employers and colleagues were devastated. Not only had Alex been an integral member of the team for nearly ten years, but her sales also accounted for more than 70% of the company’s income.

In addition to grieving the loss of a dear friend, the company was also facing a sudden and unexpected business crisis.

- How would Alex’s death impact the company’s financial viability?

- Who could take on maintaining the relationships with her current customers?

- How would they continue to develop the prospective customers in her huge pipeline?

- How much would her loss impact the company’s revenue. And would they be able to survive it?

If the company had a key person policy for Alex, they would have had a financial buffer to keep them afloat while they worked through the loss and developed a plan to care for her customers and replace the income she generated.

Key persons or employees are defined as those whose expertise, knowledge, or relationships are crucial to the company’s operations and revenue.

Key person insurance is a type of life or disability insurance that businesses use to protect themselves from financial losses that happen as a result of the death or prolonged absence of a key employee. It’s an important type of insurance for companies that rely heavily on a specific employee or employees for the business’s success.

Alex would definitely fit in that category. Because she brought in over 70% of her company’s sales, her death would significantly impact the company’s bottom line. Daily workflow would also be taxed, both in maintaining Alex’s current business load as well as pursuing new clients. And the company would need to put time and resources toward finding and training a replacement, which can be an extremely time-consuming and costly process.

How Key Person Insurance Works

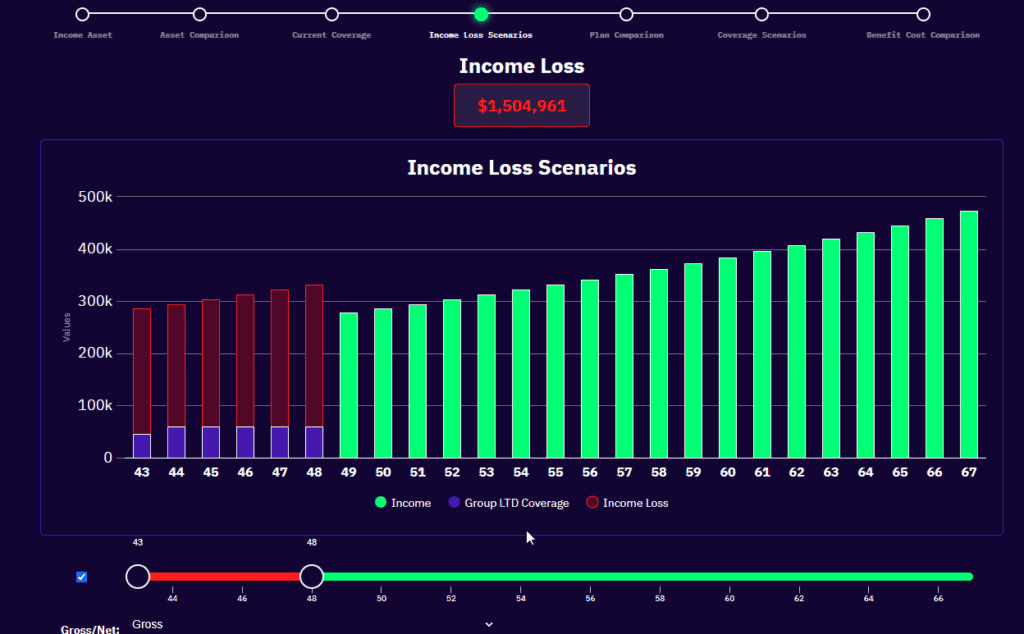

With key person insurance, Alex’s company could have received as much as $1.5 million from the insurance carrier to mitigate the financial impact and help the company continue to run smoothly in the face of this major change in plans. This money could have been used to:

- Provide support to maintain relationships and keep Alex’s customers happy

- Hire and train a replacement salesperson to fill the gap left by Alex’s absence

- Cultivate Alex’s pipeline of potential new business

- Cover a variety of other expenses directly caused by her absence

Of course, the specific amount of coverage will vary depending on the type of policy, the key person’s salary, their role in the company, and the associated revenue.

The key person benefits cover more than the death of an employee.

If a key employee become unable to work for a prolonged period of time due to an illness or injury, key person insurance can also cover that. In addition, another advantage to having key person insurance is that it can be used as collateral for loans. Often, lenders require businesses to have key person insurance policies to secure loans or lines of credit, as it provides additional security to the lender that the business will be able to repay the loan even if a key employee were to unexpectedly die or become disabled and the business’s revenue suddenly dipped.

Key person insurance can also be used to strengthens a company’s succession strategy. Should someone in a leadership position unexpectedly pass away, key person insurance can help keep the business running as well as cover costs of recruiting and training a replacement, which can help ensure a smooth transition.

Does your company need key person insurance?

Every situation is different, but a good place to start is by asking yourself what it would look like if your company suddenly lost the income generated by a top producing employee. How much impact would that make on your ability to stay in business?

Any company that relies on specific employees for a significant portion of their business revenue should consider adding key person insurance to their financial strategy.

If you’d like to learn more about how key person coverage can strengthen your company’s financial plans, I’d be happy to talk with you.