Does the long-term disability policy included in your employee benefits package offer real coverage or a false sense of security?

If your employer provides group long-term disability insurance you may think you’re covered, but are you?

Many employers offer group long-term disability (LTD) coverage as part of their employee benefits packages. If you’re ever unable to work due to an illness or injury, LTD insurance is there to help you maintain your lifestyle and financial stability. LTD policies vary greatly from one organization to the next. However, what they often have in common is that if you ever need to use them, they will frequently only replace a fraction of what you would have been able to earn. This is especially true if you’re a high earner or bonuses make up a portion of your income.

Let’s see how typical group LTD policies work in a couple of real-life situations’.

Is Sam’s policy all he thinks it is?

Sam is a 49-year-old attorney working in a large firm. He earns $250,000, plus bonuses.

Sam expects the group long-term disability policy provided in his employee benefits package to cover him if he’s ever unable to work due to a disability. Let’s look at what would actually happen:

Like many group LTD policies, Sam’s only pays a percentage of his annual salary — and there’s a cap on how much of his salary is eligible for coverage. In this case, Sam’s policy covers 60% of the first $100,000 and doesn’t cover any of his anticipated bonuses.

Even without factoring in the lost bonuses, Sam’s annual income deficit will be a whopping $190,000. And, on top of that, because Sam’s policy is paid for by his employer, Sam will have to pay state and federal income tax on the $60,000, making his financial shortfall even more dramatic.

Janet insures her assets, but she’s overlooked the most valuable one.

Janet is a 43-year-old Medical Device Sales Rep. Her base salary is $200,000 and she receives a $100,000 bonus each year.

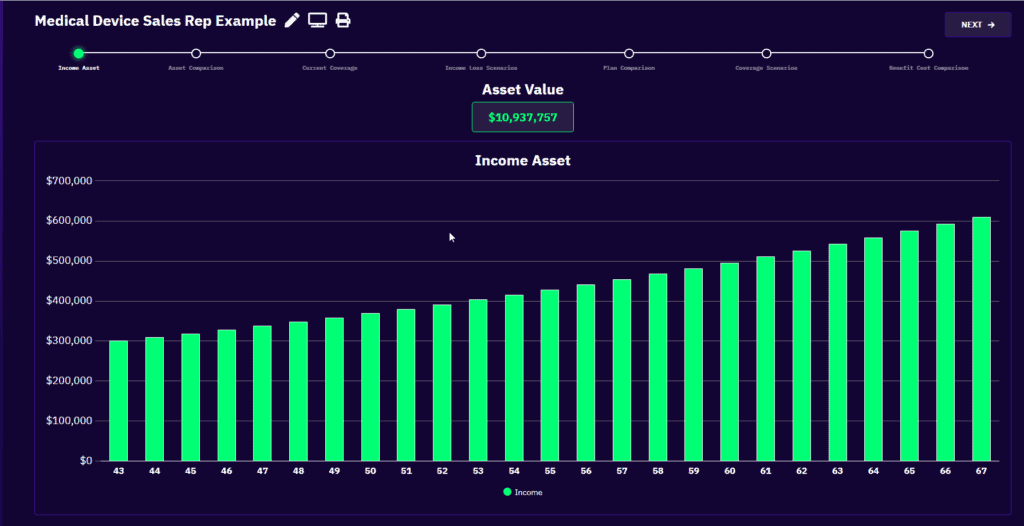

Janet has insurance policies that protect her home (valued at $500,000) and her two cars and boat (valued collectively at $85,000). Altogether, she pays $7,200 a year to protect assets worth $585,000. But what about Janet’s most valuable asset? Her earning potential?

If Janet continues working and earning at her current trajectory, she stands to earn close to $11 million.

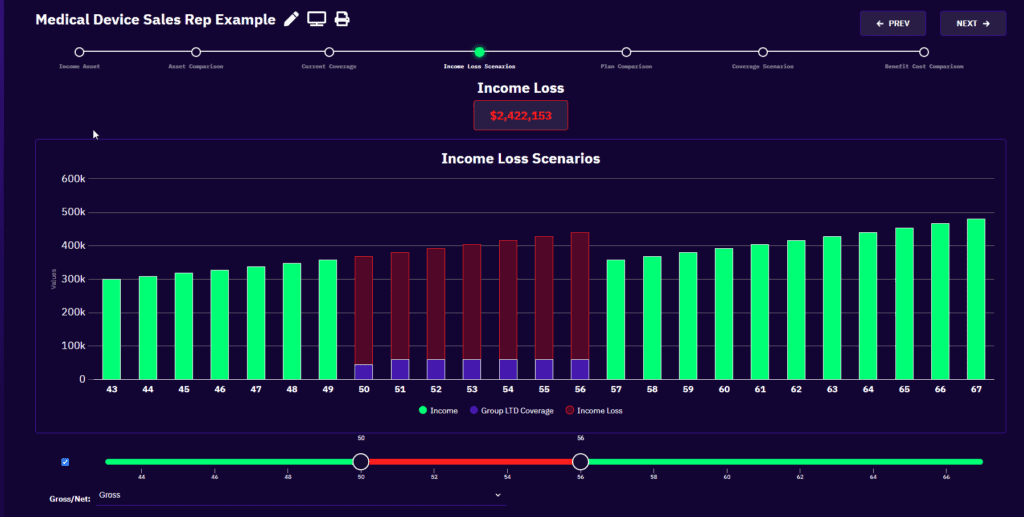

She believes her future income is secure because her employee benefits include a group long-term disability policy. However, let’s walk through the reality of what that policy would cover if, Janet becomes disabled at the age of 50 and remains out of work for six years.

After a 90-day waiting period, Janet’s policy will begin to cover 60% of her base salary up to a maximum of 5,000. Her expected bonuses aren’t factored into her coverage at all.

Over the course of the six years that Janet isn’t able to work, she will receive $405,000 (which will be less after federal and state income taxes).

However, if Janet had been able to continue working, during those six years, she would have earned $2,827,153. So, instead of protecting her income, Janet’s group policy would leave her with a 2.4-million-dollar income deficit.

How do Sam and Janet’s situations apply to you?

If you’re relatively young and in good health, the idea of finding yourself unable to work due to illness or injury may seem remote. While I certainly hope that is the case for you, consider the odds.

One out of four 24-year-olds

will be unable to work due to disability for at least 12 months before they reach the age of retirement (1)

34.6 months

The average length of long-term disability claims.

Only 40%

of Americans have enough savings to cover even three months of lost wages. (2)

The most common causes for long-term disability claims aren’t rare: (1)

- Musculoskeletal disorders (27.6%)

- Cancer (15.0%)

- Injuries such as fractures, sprains, and strains of muscles and ligaments (12.0%)

- Mental health issues (9.3%)

- Circulatory (heart attack, stroke) (8.2%)

You don’t have to risk your future on a false sense of security.

Personal LTD policies offer far more comprehensive, tailored solutions for people like Sam and Janet than those provided in most employee benefit packages. For example, by purchasing their own LTD policies, Sam and Janet could have covered all of their base pay, plus their bonuses – and they’d get to keep more of that money because the benefits wouldn’t be subject to state and federal income taxes.

If you earn a high salary and your income includes bonuses, a personal disability policy can help ensure that you and your family will be able to maintain your lifestyle and financial stability in the event of a disability, whether due to a common illness like cancer or a back injury.

If you’re wondering if the long-term disability policy your employer provides really has you covered, I’d be happy to talk with you. To set up a call, just drop me a note.

References:

1. Integrated Benefits Institute, Health and Productivity Benchmarking 2019 (released September 2020), Long-Term Disability, All Employers. Condition-specific results.

https://files.ibiweb.org/uploads/general/Sample-Reports.zip

2. Social Security Administration, Disability and Death Probability Tables for Insured Workers Born in 1999 https://www.ssa.gov/oact/NOTES/ran6/an2020-6.pdf, Table A.